Business success is predicated on understanding the key levers of influence. After all, Influence, by definition, is the ability to affect the behavior of others in a particular direction, leveraging key tactics that involve, connect, and inspire them (Hallenbeck, 2023).¹ Thus, business success is contingent on influencing your consumer base to buy your product or service.

So, what influences your purchase decisions? Do these influences change when buying food or clothing or technology? In September 2023 HUNTER, a leading consumer marketing communications firm, began to explore this topic, fielding this simple open-ended question to 7,000 consumers: 1,000 consumers who recently purchased an item or service from seven different product sectors. Responses were varied and complex, including factors such as emotional motivations, criteria used to evaluate product benefits and/or price, the specific channels through which consumers became aware of the product or service, as well as the channels they employed to learn more about the product or service.

THE SEARCH FOR ANSWERS

Given the importance of channel of communication in the influence process, it gives rise to the question, how are these levers of influence being impacted with all the significant changes occurring in our media landscape. Over the past decade, we have seen the rise of the pervasive 24-hour news cycle, the proliferation of digital platforms, social media, and personalized content, and the growing distrust towards traditional news sources. Mintel’s report on the US media landscape surmises, “Consumers have more media options than ever before – both in terms of channels as well as the content available; and consumption is keeping apace. Getting – and keeping – consumers’ attention is increasingly challenging” (Mintel, 2023).²

We hypothesized that these transformational changes have undoubtedly altered how consumers are influenced in their purchase journey and that social or digital sources would be the lead sources of influence across all categories. We also believed that motivational and functional influences would be very different by product category but that the influences exerted by channels of communication would be much more universal.

Using the direction from our exploratory survey, HUNTER partnered with Libran Research & Consulting to develop a quantitative survey that comprehensively explored “Influence in America” across all its critical factors. The study, conducted in Q4 2023, sought to identify the key influences for each product sector, providing a deep exploration into the specific sources driving product awareness and purchase choice.

UNIVERSAL TRUTHS ON SOURCES OF INFLUENCE

Results revealed that leading sources of influence were not consistent across product categories. Sources more likely to be referenced in one category, may take a back seat in another category. For example, Friends and Family are the leading source of information influencing the Travel Sector, but Digital Media tops the list for Technology. However, comparison across all seven categories did yield a few fundamental principles that are more universal in their occurrence. Understanding these principles can drive more effective communication plans and programs.

1. Awareness is Paramount

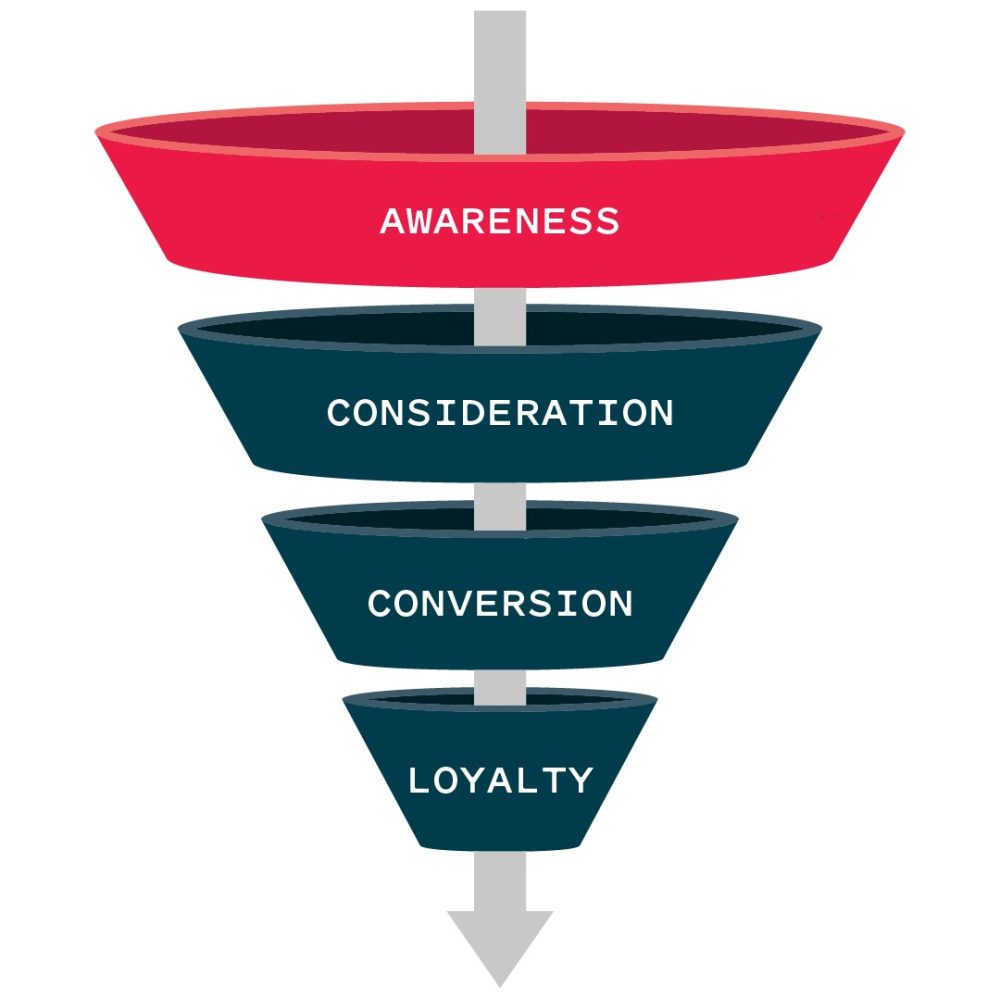

Awareness-driving influences are the most important sources of purchase across most categories, as 20-40% of consumers who recently purchased products from our seven categories under investigation did not use a secondary source to learn more about products after initially becoming aware of them. Those who do seek additional information prior to purchase tended to use the same channels in which they initially became aware of the product/service. Therefore, whether you are introducing a new product or driving brand purchase, prioritizing top-of-funnel awareness-building efforts is essential.

2. Consumers Consult Multiple Information Sources

Consumers typically consult multiple sources throughout their purchase journey. As you would expect, there is a strong correlation between the level of perceived risk of the purchase and the number of sources referenced to make it (r2 = .70). On average, the greatest number of sources are used for technology (4.4) and travel (3.9) and the fewest number of sources are referenced for food and beverage (2.2) and fashion (2.3). Households with kids and BIPOC households tend to view all purchase decisions as riskier than mainstream households, on average 10% and 7% more risky respectively – thus, consumers in these households tend to consult more sources before making a purchase (on average, 25% and 16% more sources, respectively). This learning underscores the importance of a multi-channel strategy, as 2-5 sources are typically referenced between awareness and purchase across all product sectors.

3. Real-Life Influence (IRL) Beats Online Influence (URL)

Despite the digital disruption we are experiencing in nearly every category, real-life experiences have the greatest influence over purchase intent. In-store interaction is the #1 source of influence driving awareness (ranging from 34% – 51%) and learning more (ranging from 27% – 33%) across 5 of the 7 measured categories. Additionally, when consumers become aware of a product in-store, they are more likely to buy it in-store (r2 = .73), which is not true for online sales (r2 = .18). So, remember the IRL retail component of your marketing mix to capitalize on this behavior.

4. Word-of-Mouth (WOM) Wins

“Person I Know” continues to wield powerful influence in terms of driving awareness and purchase intent across most categories. They are the strongest personal influence in the Travel sector (awareness source = 52%, learn more source = 38%) and the second most important source for awareness and learning more in Food and Beverage (17%/13%), and Healthcare (28%/20%), as well as the second most important source for learning more in Technology (24%). While word-of-mouth is often overlooked in the marketing toolkit given its perceived difficulty to activate, it can be helpful to know that social media influencers are often elevated to friendship status, particularly among the Gen Z audience.

5. Social and Digital Support Technology and Personal Expression Sectors

Despite the prevalence of social and digital media in today’s market, these sources have not emerged as the primary sources of influence across all categories. Technology is the only product sector where digital media have become the leading source of influence (awareness source = 35%, learn more source = 34%). It is the second strongest drivers of influence for awareness and learning more in categories driven by personal expression, such as Fashion (14%/13%) and Home Décor (20%/18%). Additional, social media only emerges as the second primary source of influence for Beauty Care (22%/ 19%), another category providing a means of personal expression. Therefore, while social and digital support can help complement and amplify communication efforts across most categories, they are particularly effective in the Technology and Aesthetic-Based product sectors.

6. Demographic Tendencies Can Help Predict Sources of Influence

Sources of Influence tend to be similar regardless of demographic, with only a few exceptions where particular segments show markedly different tendencies These exceptions should be considered when targeting these populations.

a. Gen Z, Millennials and BIPOC are more likely to be influenced by social media than the average consumer, both in using it to drive awareness (+65%, +47%, +32%, respectively) and in referencing it to learn more about the product (+31%, +53%, +31% respectively).

b. Influencer marketing is especially effective among Hispanic and Black consumers, as they are 63% and 41%, respectively, more likely than the overall consumer to become aware of a product through an influencer on social media and 111% and 76%, respectively, more likely to learn more about products through influencers on social media.

c. Men are more likely to become more aware of products through traditional media than women (+49%), while women are more likely than men to build awareness through social media (+ 39%).

Influence is a complicated topic with many levers to consider. Interestingly, our study ultimately showed the opposite of our hypothesis: despite the shifting media landscape and the growth of social and digital channels, many other important sources of influence from the past continue to play a leading role in influence today. Additionally, while there are several fundamental principles of influence that are universal across all categories, many factors of influence are unique to their specific categories. Thus, business success will require paying attention to specific influences within a product sector and within demographics to gain a complete picture of potential opportunities and barriers for your products or services.

Read a White Paper on the study findings here.

For a deeper dive into the study findings, join us for an upcoming ‘INFLUENCE IN AMERICA: Insights into Application’ webinar. Gain valuable insights as we explore how purchasing decisions are influenced across various product sectors and demographic segments. Our panel of HUNTER leadership from various practice areas includes:

— Heddy Parker DeMaria, Chief Insights & Strategy Officer

— Kasia Pandyra, SVP Entertainment

— Lisa Horn, SVP Media Strategy

— Michael Lamp, Chief Social & Digital Officer

— Donetta Allen, Chief Influencer Officer

Register for free HERE for the IPR webinar on June 4th.

Citations:

1. Hallenbeck, G., PhD. (2023, October 26). How to Influence People: 4 Skills for Influencing Others. Center for Creative Leadership. [https://www.ccl.org/articles/leading-effectively-articles/4-keys-strengthen-ability-influence-others/#]

2. Mintel. (2023). Media Landscape, US – Retrieved from Mintel Reports database.

Since joining HUNTER in 2019, Heddy DeMaria has stewarded best-in-class insights, measurement and strategy practices across the entire agency and each of its client partners. As HUNTER’s first-ever Chief Insights and Strategy Officer, she oversees a passionate team of analysts and planners who leverage HUNTER’s proprietary insights processes and extensive toolkit to ensure the agency’s communication strategies are always grounded in data and research, culturally relevant, and designed to earn consumer attention and drive quantifiable business results. She has also developed a range of strategic workshops including building brand foundations, identifying value propositions, clarifying corporate culture & purpose, and strengthening brand stories, each employing proprietary tools and techniques, that ultimately lead to stronger brands positioned on a path towards growth.

Prior to HUNTER, Heddy brings 25+ years of experience to HUNTER, having held leadership roles across multiple disciplines including Consumer Insights, Shopper Insights, Brand Strategy, Innovation and Advanced Analytics, all while working across a diverse range of business models and product sectors that have spanned global corporations (Kraft, VF-Corp), entrepreneurial ventures (Pinnacle Foods) and global agencies (Nielsen Marketing Research).