Warren Buffet’s much repeated mantra ‘We can afford to lose money — even a lot of money. But we can’t afford to lose reputation — even a shred of reputation’ has long asserted the economic case for corporate reputation. While few would disagree, fewer have been able to put a figure on just how much value is tied up with corporate reputation. Until recently.

Reputation value analysis is an objective and fully transparent means to disentangle the extent to which, and how, company reputations are, by building confidence within the investment community, serving the companies they support and creating tangible value for shareholders.

This is critical intelligence for the C-suite and the managers of reputation assets.

- The insight it brings into the scale and mechanics of the value-generating capacity provides the means to make sure that corporate communications work as hard as they can. Insight that is key throughout the economic cycle and not least, in times like the present, when uncertainty and volatility can all too easily distract attention and derail progress. Reputations are not things that get picked up only in the good times and put down at other times, as their hard and significant values demand constant support.

It goes without saying that investors have had to deal with an unusually toxic cocktail of macro-economic events in recent years, particularly most recently. The engine for global growth that has been China, stalled as concerns for the ability of their government to manage the economy increased. The travails of the Eurozone showed little sign of being resolved only to become exacerbated by the refugee crisis and the UK’s Brexit vote. The post-crash oil-price ‘rally’ in early 2015 proved to be a somewhat short-lived dead-cat-bounce and was compounded by a wider slide in commodity prices and growing realization that low prices were set to stay for some time. On top of that the strength of the USD continued to create problems for many companies while on the political front, the rise of populist, protectionist sentiment around the developed world, and the election of Donald Trump, have raised a host of difficult questions and even greater uncertainty for the established orders.

This has led to many investors to develop a tendency towards circumspection and exhibit distinctly less optimism for short-term commercial prospects. Sentiment has become increasingly characterized as ‘watchful’ as opposed to ‘nervous’ with the effect that there has, at the least, been a growing nod to the ‘safety’ inferred from strong corporate reputations.

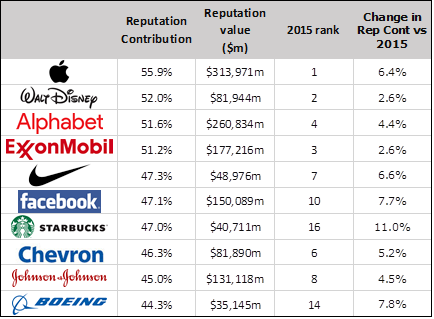

One effect of that has been an increase in investor ‘reliance’ on corporate reputation as a vehicle to guide and secure confidence in the economic returns they were expecting from their investments. The 2016 US Reputation Dividend report noted that in March 2015 reputations accounted for an average of 18.2% of market capitalization across the S&P 500, and a year later, in March 2016, they were delivering 20.7%, or $3,977bn worth of shareholder value. Reputation Contribution – the proportion of corporate value accounted for by reputation – was up by an average of 2.5% points mitigating the downward pressure on stock prices leaving shareholders across the index $584bn better off.

These findings are, on the one hand a testament to the ability of corporate communicators in managing their intangible assets, while on the other, a sign that there can be no let-up if the gains are to be secured into 2017 and beyond.

Corporate reputations can, without question, be a major source of value creation for companies and as such, must be managed alongside other corporate assets for the strategic role they can play, not least if the company is to be rewarded with approval from the Sage of Omaha.

The full study is freely available for download at:

The 2016 US Reputation Dividend Report

The 2016 US Reputation Dividend Report

Sandra Macleod is the CEO of Mindful Reputation & Director Reputation Dividend. Follow her on Twitter @MindfulRep.

Sandra Macleod is the CEO of Mindful Reputation & Director Reputation Dividend. Follow her on Twitter @MindfulRep.

Sandra Macleod is the CEO of Mindful Reputation & Director Reputation Dividend. Follow her on Twitter

Sandra Macleod is the CEO of Mindful Reputation & Director Reputation Dividend. Follow her on Twitter